Islamic Financial Institution Australia Palms Back Radi

본문

Islamic finance rules, which adhere to the rules of Shariah legislation, are increasingly being acknowledged as an ethical and sustainable... Sustainable infrastructure growth is essential for attaining financial development while safeguarding ethical principles. In latest years, there was a rising recognition of the necessity to finance infrastructure tasks that promote environmental sus... Empowering Rural Communities via Halal FinancingIn current years, there has been rising recognition of the potential of halal financing to uplift rural communities and drive financial growth in these underserved areas. Halal financing has emerged as a strong device for empowering Muslim entrepreneurs and unlocking their full potential. By adhering to Islamic principles and avoiding interest-based transactions, Halal financing offers a viable different to tradit...

- Therefore, it requires that one should not be in a place to obtain income from money alone.

- Conventional loans, also called interest-based loans, are the most widely used form of financing within the...

- We provide a comprehensive array of Sharia-compliant financial providers specifically designed to satisfy the wants of the Muslim neighborhood.

- ICFAL invitations memberships from community group, businesses and different organisations to join a membership fund of over $50+ million that provides shariah compliant finance and dividend distributions to members.

Are You Eligible For A Loan?

Entrepreneurship is a crucial driver of financial progress, innovation, and employment, and Muslim communities around the globe are not exempt from this phenomenon. However, Muslim entrepreneurs face unique challenges in accessing financial options th... Micro and small businesses play a significant position in the economic growth and improvement of any nation. These enterprises typically face significant challenges in phrases of accessing financing that aligns with their moral values. Halal financing has emerged as a key driver of infrastructure progress in Islamic nations, unlocking their financial potential and paving the way for sustainable growth.

Impression Of Halal Loans On Rural Financial Progress And Poverty Alleviation

Many Islamic beliefs impose boundaries, restrictions, or limitations on monetary issues similar to what is appropriate kinds of earnings or business practices. These practices may conflict with non-Islamic monetary instruments. In an effort to not exclude a physique of people due to their non secular beliefs, a set of Islamic financial principals and monetary system entities cater to the accepted monetary practices of Islam. Accordingly, Sharia-compliant finance (halal, which implies permitted) consists of banking in which the financial establishment shares in the revenue and lack of the enterprise it underwrites. In a financial context, gharar refers to the ambiguity and deception that come from the sale of items whose existence is unsure.

The murabaha transaction provides a structured and transparent technique for buying a property, without interest or hidden charges. This method allows individuals to achieve property possession whereas following the guidelines set by their faith, making it a helpful choice for these looking for a Halal way to fulfill their homeownership aspirations. Islamic finance in Australia has been rising steadily over the years, with a quantity of banks and monetary establishments offering Sharia-compliant financial products. Some of the main players in the business embody Westpac, National Australia Bank (NAB), ANZ, and HSBC.

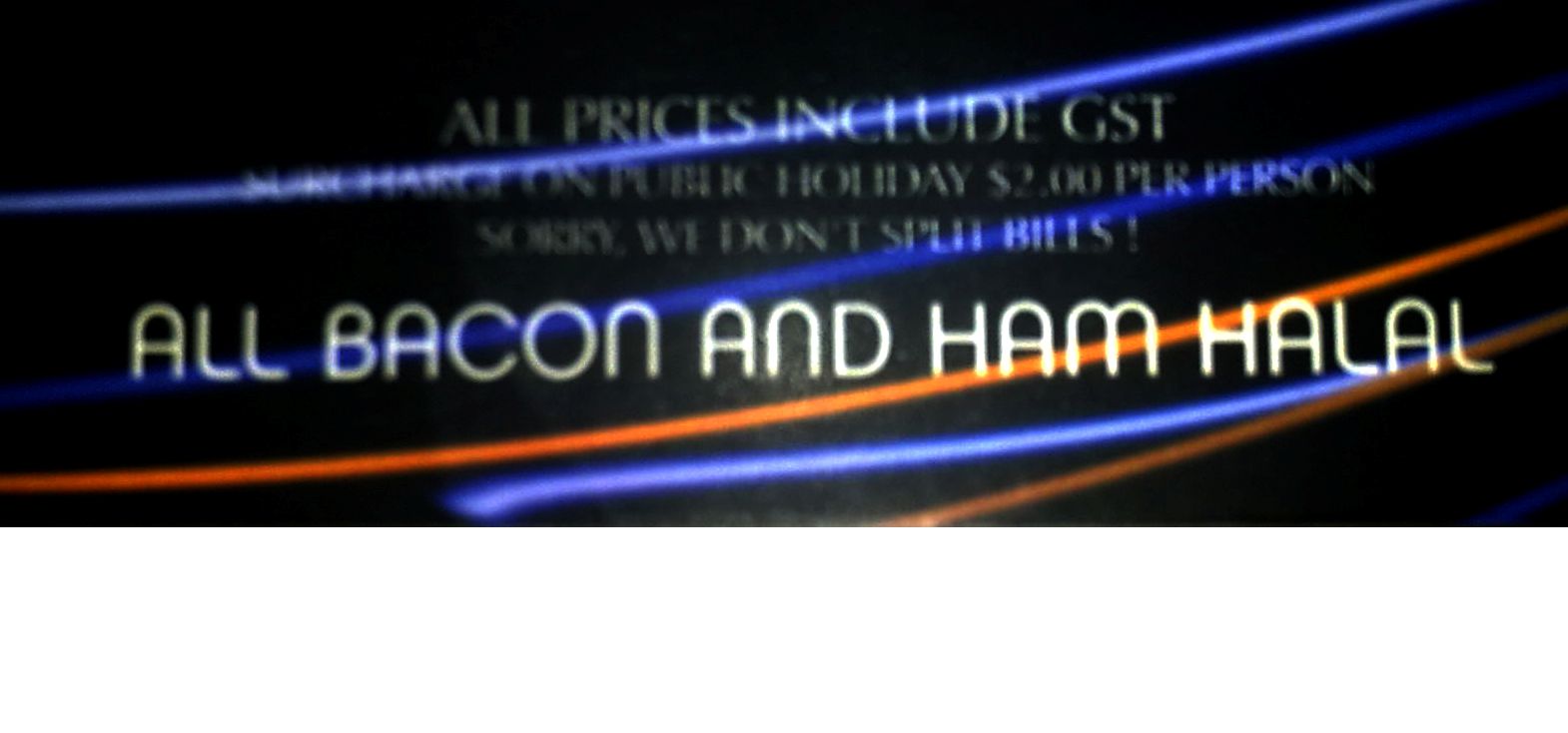

At Crescent Wealth, it's our mission to provide excellent Islamic superannuation choices to our prospects, both Muslims and non-Muslims. With a give attention to remaining Sharia-compliant and doing good with our investment funds, we choose the most effective performers across socially moral investing out there. Investing in Muslim superannuation funds that comply with Sharia legislation permits for ethical investing. You can skip potential investment options that embrace income from monetary interest, alcohol, pork, immoral entertainment, violence, and more.

Sign a contract to buy a property + obtain constructing inspection. Obtain a preapproval letter confirming the lenders preparedness to lend you the cash with any conditions famous. There's no magic formulation or trick to getting your personal loan utility accredited however there are some practical measures y...

A group of individuals pay into a pool of funds that an insurance coverage skilled maintains. A person is buying an insurance bundle without knowing if they may ever need it. But Islamic banks have made alternatives to conventional insurance obtainable. They might help buy out firms so long as they aren't violating Islamic regulation. But both parties make a mutual settlement about the markup, and the customer pays for it instantly. A vendor and buyer take part in cost-plus pricing, agreeing on the identical value of an asset.

Faleel Jamaldeen, DBA, is the founder and editor of the Islamic Finance Expert web site (ifinanceexpert.wordpress.com). He is an Assistant Professor at Effat University, Jeddah, Saudi Arabia, the place he teaches programs in typical finance, Islamic finance, and accounting. At Halal Loans, our commitment to excellence goes beyond words – it’s reflected within the rave evaluations from our happy prospects. With an average score of 5 stars throughout Google, Facebook, and Trustpilot, it’s no surprise why our purchasers belief us for their Islamic banking wants. You must learn the product disclosure statement (PDS) for the Salaam Wealth Superannuation Fund.

댓글목록 0

댓글 포인트 안내